Average deductions from paycheck

Calculate the average by adding the base pay from your last few paycheck stubs and dividing the total by the number of pay periods you added together. Overview of Oregon Taxes Oregon levies a progressive state income tax system with one of the highest top rates in the US at 990.

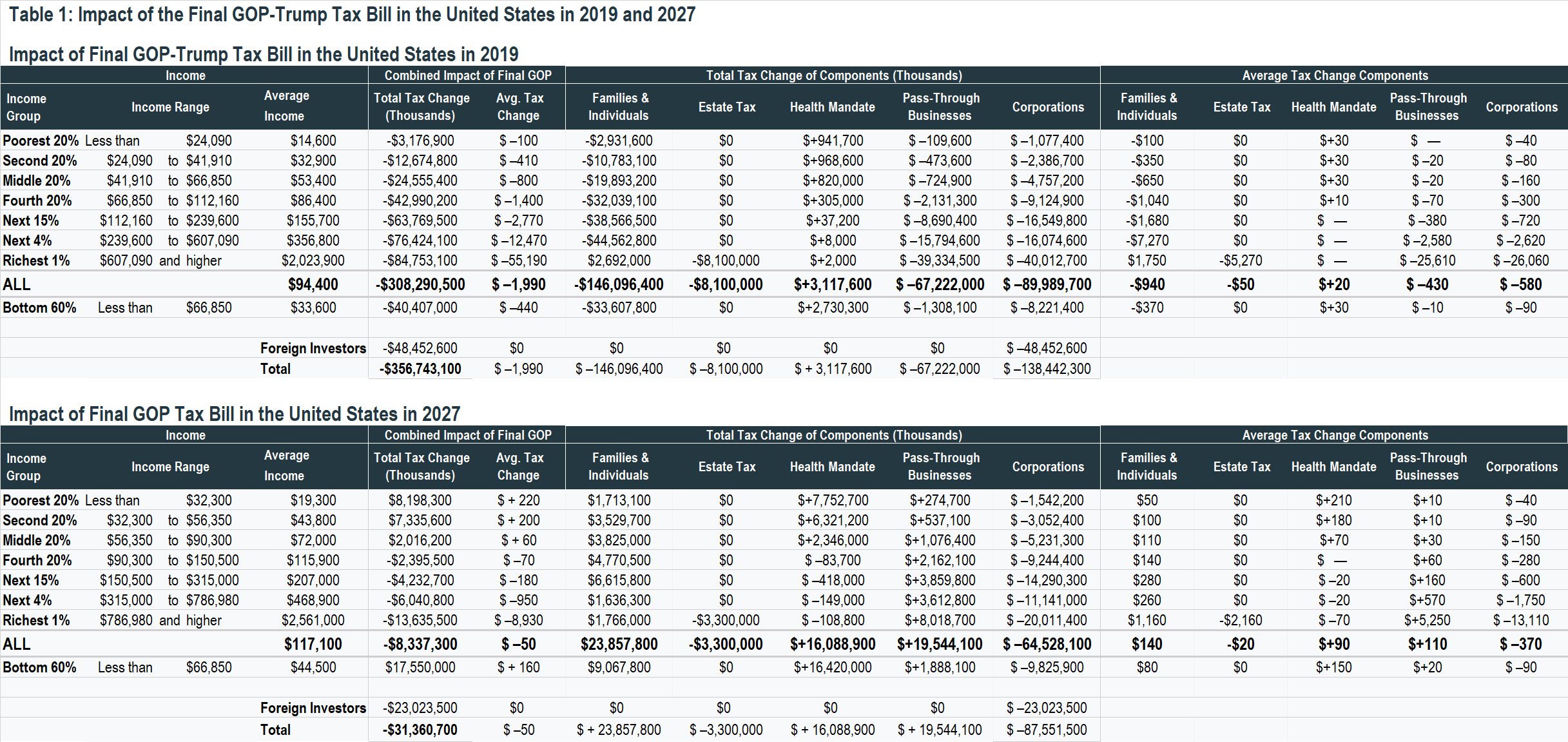

How Much Will Typical Middle Class Workers Really See Their Paychecks Change Itep

Contributions to a traditional IRA may be tax deductible.

. Skip To The Main Content. Already Have an Account. Every paycheck includes a simple breakdown of hours taxes deductions and more.

While leaving a job after resigning or being fired can be tough understanding the rules on final paychecks can help reduce some of the anxiety. Click to see what payroll deductions changes will do to your next paycheck for free. Wisconsins maximum marginal income tax rate is the 1st highest in the United States ranking directly.

These options allow you to reduce the tax withheld through claiming tax credits or deductions. Wisconsin collects a state income tax at a maximum marginal tax rate of spread across tax brackets. You can also add other sources of income or extra withholding if you find you want more money withheld from your paycheck.

Like the Federal Income Tax Wisconsins income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. Transaction records Get a clear record of your debit card activity so. Earn 62X more interest¹ than the national average Free withdrawals at 37000 ATMs nationwide⁵.

Tools such as withholding tax calculators can help you figure out what to fill in on the various steps of Form W-4. The maximum contribution to a 401k in 2022 is 20500 27000 if youre 50 or older. For example your employer will deduct money from each of your paychecks if you make contributions to retirement plans such as a 401k or health plans such as a health savings account HSA.

Run your first payroll in 10 minutes. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Your take-home pay will usually be at least 10 percent less than your gross income because of taxes and deductions.

Tax deductions lower your taxable income. If the number you enter here is lower your standard deduction will be used to determine your average tax rate. Virginia law states what if any deductions an employer can take from a final paycheck and what additional wages must be included such as pay for commission and unused vacation time.

Other factors affecting the size of your paycheck include the frequency of your pay periods and what deductions youve authorized your employer to make. Online payroll for small business that is simple accurate and affordable. All 50 states and multi-state.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

What Are Itemized Deductions And Who Claims Them Tax Policy Center

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

How Does The Deduction For State And Local Taxes Work Tax Policy Center

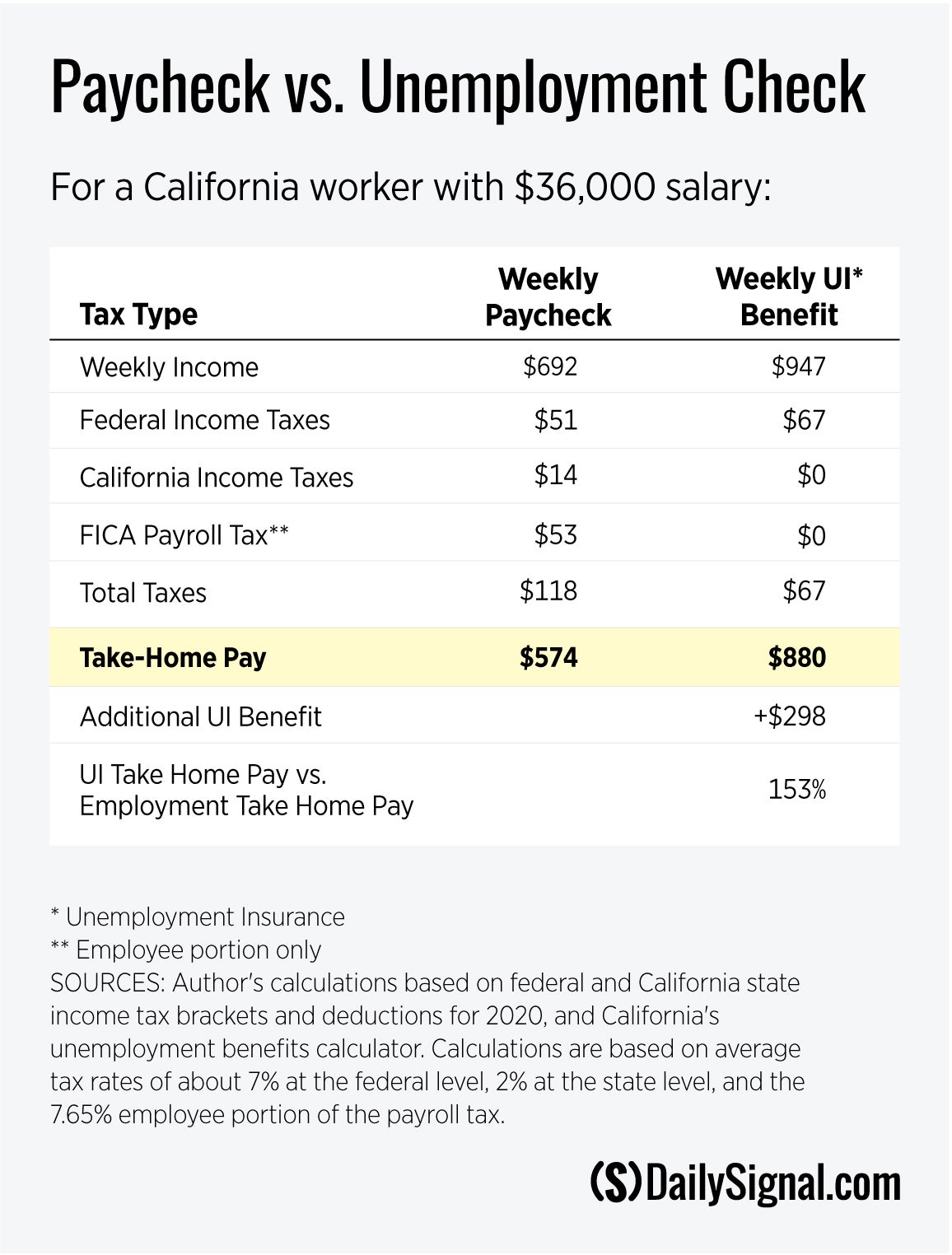

As Unemployment Keeps Rising Congress Needs To Fix What It Broke The Heritage Foundation

Check Your Paycheck News Congressman Daniel Webster

Pay Stub Meaning What To Include On An Employee Pay Stub

Glossary

The Real Numbers In Your Paycheck Southpoint Financial Credit Union

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Here S How Much Money You Take Home From A 75 000 Salary

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Different Types Of Payroll Deductions Gusto

What Is Casdi Employer Guide To California State Disability Insurance Gusto

Understanding Your Paycheck Credit Com

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center